The customer can have better control of their money by being notified when an event occurs on one of their accounts.

These alerts can be received:

- by email;

- via mobile notification.

Alerts are enabled by default, but it is possible to disable or configure these alerts to personalize them. The customer decides which alerts they wish to receive, under what conditions, and how to be alerted, account by account.

Account alerts can work on accounts, shared accounts, but also on connected bank accounts.

In the event of an unusual notification or transaction that the customer does not recognize, it is recommended to:

- Check the transaction details immediately from the application.

- Ensure that no third party has access to the account or the device being used.

- Block the card from the application.

- Contact customer service immediately to report the situation and obtain appropriate assistance.

Edit or create an alert

To access account alerts, the customer must go to the "Alerts" screen from the view of the account to be monitored.

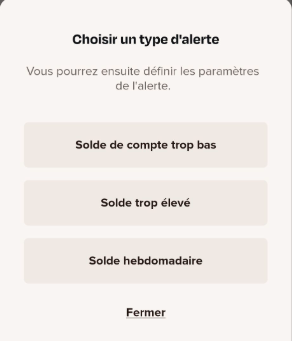

The different types of alerts

Money received or expenses

When a transaction affects the account, the customer will be notified. The transaction can be a charge or a credit to the account. If it's a charge, it can be made by the customer or by a member of the shared account who has spending rights.

Low or high account balance

When the account balance reaches a defined threshold or limit, the customer will be alerted.

Weekly balance

This alert simply provides regular updates on the account status. It is sent every Sunday morning.

Alert criteria

Communication channel

This option lets you specify whether the alert should be sent by email or mobile notification. Mobile notifications must be enabled on the phone.

Default alerts

For accounts and shared accounts

When a customer creates an account, an alert is automatically added by default to simplify its use: "transaction exceeding €0", via email and mobile notification.

The customer will be notified for each transaction. They will be able to customize their alerts at any time.

For connected bank accounts

When the customer registers an external bank account, two alerts are automatically added by default:

- "Transaction carried out exceeding €100", by email;

- "Low balance at €50", via email and mobile notification.

Transactions from the external bank account are synchronized daily.